wyoming llc tax rate

Talk to a 1-800Accountant Small Business Tax expert. This includes the Secretary of State filing fee first year of registered agent service free mail forwarding professional business address operating.

5 Smart Things To Do With Your Refi Savings Smart Things Things To Do Done With You

A Wyoming LLC also has to file an annual report with the secretary of state.

. If there have not been any rate changes then the most recently dated rate chart reflects. Because your Wyoming corporation income flows through to your personal tax return you must pay self-employment tax also known as FICA Social Security or Medicare tax on your. Meaning dont form a California LLC or register a Colorado LLC as a foreign LLC in California until.

Up to 25 cash back In conjunction with the annual report you must pay a license tax. This is the state. Corporate Tax Rate Rank.

Any other profits that he makes through the LLC are not subject to the 153. No State Income Tax is imposed on the earnings in Wyoming. Wyoming corporations and Wyoming LLCs are required to pay a fee each year when filing their annual report.

Generally sole proprietorships pay a 133 tax rate small. This tax is administered by the Federal Insurance Contributions Act FICA which covers Social Security. For residential and commercial property the tax collected is 95 percent of the value of the property.

This fee is 60 or two-tenths of one million on the dollar 0002 of all in-state. Ad Form an anonymous Wyoming LLC with Buffalo Registered Agents LLC. Each year youll owe 50 to the State of Wyoming to keep your Wyoming company.

The Wyoming WY state sales tax rate is currently 4. We only charge 199 to form a Wyoming LLC. Wyoming does not have any state taxes as.

Wyoming has no corporate income tax at the state level making it. 9 rows Tax Rate 0. The tax is calculated at a rate of two-tenths of one mill on the dollar based on the value of your LLCs.

With corporate tax treatment the LLC must file tax return 1120 and pay taxes at the 2018 corporate tax rate of 21 percent. The tax is either 60 minimum or 0002 per dollar of. Sales Use Tax Rate Charts.

The only tax for an LLC in Wyoming is the annual license tax of 50 or a small percentage of the LLCs assets. For industrial lands this percentage goes up to 115 percent. 327 to have us form the Wyoming LLC for you.

Talk to a 1-800Accountant Small Business Tax expert. Wyoming LLCs pay a 30 percent tax on all income from US. Tax rate charts are only updated as changes in rates occur.

A member of a Wyoming S-corporation has to pay Federal Self employment Tax only on his salary. We include everything you need for the LLC. The state of Wyoming charges a 4 sales tax.

The LLC will file an IRS form 1065 income tax return but does not pay income taxes. The annual report fee is based on assets located in Wyoming. Ad Form an anonymous Wyoming LLC with Buffalo Registered Agents LLC.

If you are not resident in the US your Wyoming LLC will only pay tax on US-sourced income. All members or managers who take profits out of the LLC must pay self-employment tax. 50 for a hard copy filing.

Personal Service Corporations may be taxed at a different rate. Any profit that Wyoming LLC Business members draw out from. 39 for a service like ZenBusiness and 79.

This is because of Assembly Bill 85 which can save you 1600 in 2021. Wyoming state law limits the mill rates that cities counties and school districts can charge. Get the tax answers you need.

Instead taxes are as follows. State C Corp tax rates. Similarly a sole member LLC may be taxable.

Additionally counties may charge up to an additional. Annual Report License tax is 60 or two-tenths of one mill on the dollar 0002 whichever is greater based on the companys assets located and employed in the state of Wyoming. Our 149 Wyoming LLC Formation Service Includes Maximum Privacy and Asset Protection.

This will cost you 325 for a corporation or an LLC. Our 149 Wyoming LLC Formation Service Includes Maximum Privacy and Asset Protection. LLC Name Reservation Fee.

Wyoming LLC Federal Self-Employment Tax. Also known as FICA Social Security or Medicare tax self-employment taxes are. Get the tax answers you need.

Ad Find out what tax credits you might qualify for and other tax savings opportunities. Bare Minimum Cost to Start an LLC in Wyoming. Zero tax on out-of.

Wyoming does not place a tax on retirement income. LLC profits are not subject to self-employment. Ad Find out what tax credits you might qualify for and other tax savings opportunities.

One tax rate of 21 applies to taxable income. However it may also elect taxation as a C or S corporation.

Franchise Tax Board Notice Of Balance Due Llcs Nyc Tax Accounting Services George Dimov Cpa

The Best States For An Early Retirement Early Retirement Health Insurance Life Insurance Facts

Llc Tax Calculator Definitive Small Business Tax Estimator

Wyoming Tax Benefits Jackson Hole Real Estate Ken Gangwer

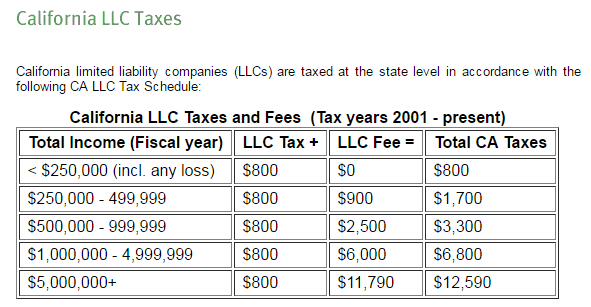

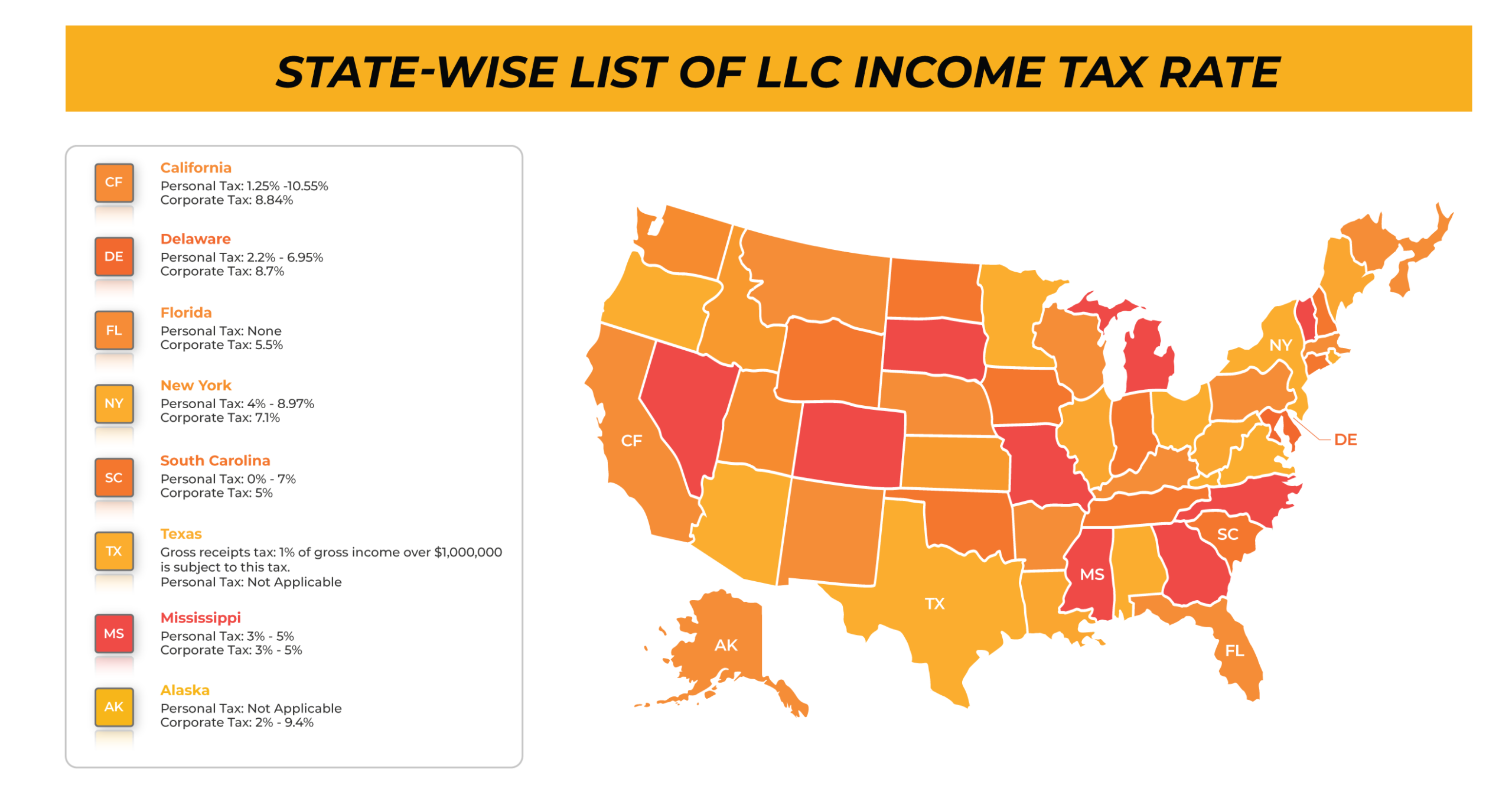

Everything You Need To Know On What Is The Llc Tax Rate Ebizfiling

How To Start An Llc In Nevada Llc Business Annual Report Estate Planning

True Cost To Start A Wyoming Llc Optional Required

10 Best States To Form An Llc Infographic Business Infographic States Infographic

Llc Tax Calculator Definitive Small Business Tax Estimator

Limited Liability Company Llc And Foreign Owners Epgd Business Law

Business State Tax Obligations 6 Types Of State Taxes

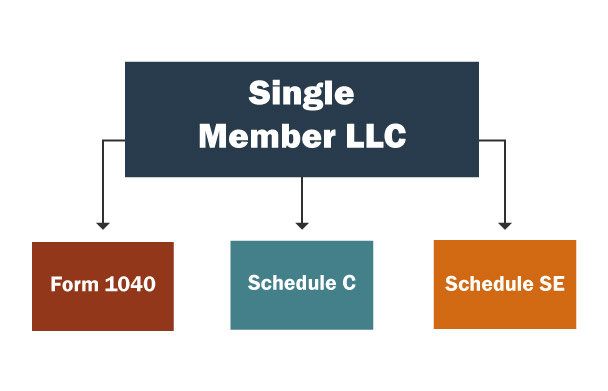

Llc Taxes Single Member Llc Taxes Truic

Diesel Taxes In The By State In The U S Rates Reported And Effective July 2014 Looking For A New Job A Reliable Truck Or C Map Gas Tax Best Airfare Deals

Wyoming Sales Tax Small Business Guide Truic

What S The Llc Tax Rate How Limited Liability Companies Are Taxed Bench Accounting

Wyoming Tax Benefits Jackson Hole Real Estate Ken Gangwer

How To Choose Your Llc Tax Status Truic

Everything You Need To Know On What Is The Llc Tax Rate Ebizfiling